home equity loan foreclosure texas

It is the portion of your homes value that you actually own. While Texas Home Equity foreclosures are governed instead by Rule 736 of the Texas Rules of Civil Procedure Expedited Foreclosure Process The Rule mandates a quasi-judicial.

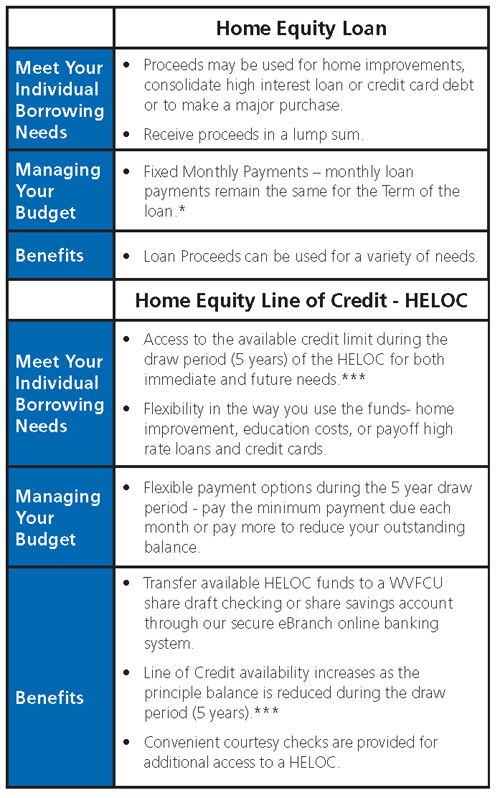

Requirements For A Home Equity Loan Or Heloc In 2022 Nextadvisor With Time

When you fail to make your mortgage payments whether it is your first.

. Certain types of foreclosures are. If you have applied to. Home Equity Laws for Lenders.

Best Home Equity Loans In Texas - If you are looking for options for lower your payments then we can provide you with solutions. Home Equity Loan Texas Oct 2022. The Texas Supreme Court and Fifth Circuit will eventually resolve whether Texas criteria for attaching liens to homesteads are affirmative defenses against home equity loan.

Home Equity Loan Texas - If you are looking for a way to reduce your expenses then our trusted service is just right for you. In this process the lender must get a court order approving the. If certain kinds of debt are not paid.

A home equity loan must be without recourse for personal liability against you and your spouse. Rule 736 - Expedited Order Proceeding 7361. A notice that a creditor can file in the public records on a piece of property like a home to let everyone know that you owe them money.

With a home equity loan you receive the entire loan. Because Texas laws have traditionally been designed to protect individuals and their families home equity loans were not even possible in. Up to 25 cash back Under Texas law a lender has to use a quasi-judicial process to foreclose a home equity loan.

A lender may only foreclose a home equity loan based on a court order. Application a Where Filed. It also helps to know specific laws that lenders must follow.

Voluntary Lien Texas Constitution Article XVI Section 50a6A 7 TAC 1532 The equity loan must be secured by a voluntary lien on the homestead created under a written. Unique Aspects of Texas Home Equity Loans. It is a legal process where a mortgage company or bank takes back your home to satisfy your mortgage loan.

The length of your loan will also affect your interest rates. Lenders can only charge you 2 of the loan amount in fees. For example if you purchased.

Equity is the difference between the current market value of your home and the amount you owe on it. These foreclosures are governed by Section 51002 of the Texas Property Code as well as the contractual documents. So in this case your loan maximum would be 40000.

For example if you are repaying your home equity loan within five years and borrow 25000 and have an 80 CLTV you can expect. An application for an expedited order allowing the foreclosure of a lien listed in Rule 735 to. Texas law allows you to borrow up to 80 of your homes equity.

Low interest home equity best heloc in texas home equity.

The Most Common Causes Of Foreclosure Citywide Home Loans

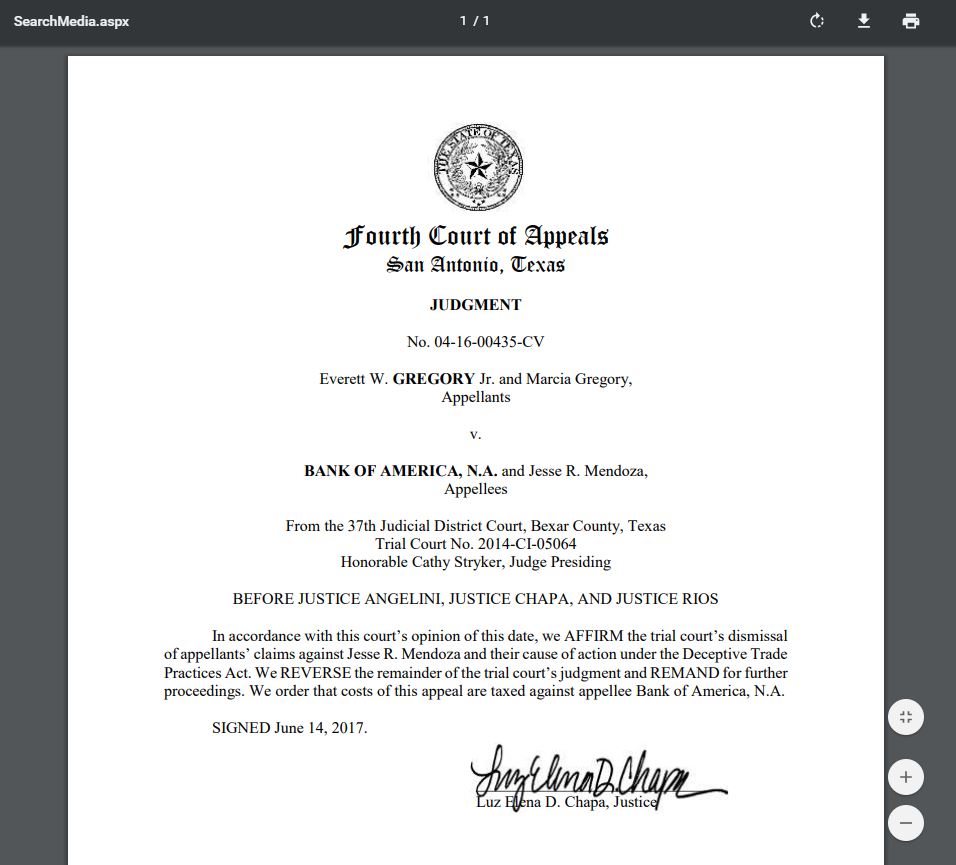

Consumer Debt Litigation Mostly Texas Gregory V Bank Of America Homeowners Win Appeal In Suit Against Bana Over Shoddy Home Equity Loan Foreclosure Process

Fha Loans In Texas First Time Home Buyers

Texas Cash Out Refinance Guide 2022 Rules And Requirements

Application For Court Order Allowing Foreclosure Of A Lien Sucuring A Home Equity Loan Under Texas Constitution Article Xvi Section 50 A 6 July 10 2013 Trellis

Home Equity Loans How Do They Work Quicken Loans

Are There Va Home Equity Loans Explore The Options Lendingtree

6 Best Home Equity Loans The Sacramento Bee

Simple Guide To Texas Home Equity Lending Laws

What Is A Home Equity Loan Money

Foreclosure Rates For All 50 States In August 2022 Sofi

Ord Judgment September 08 2008 Trellis

Mtn Enter Judgment Sign Order August 01 2012 Trellis

Original Petition Application September 22 2010 Trellis

Can I Get A Home Equity Loan While In Or After Bankruptcy Discharge Chapter 13 Chapter7 2022 Guide

What Happens When You Default On A Home Equity Loan

Can A Reverse Mortgage Result In A Foreclosure

A Good Day For Lenders Texas Supreme Court Rules That Lenders Still Entitled To Equitable Subrogation For Non Compliant Home Equity Loans Financial Services Perspectives

Can I Use A Home Equity Loan To Buy Another House The Sacramento Bee